Global Asset Allocation Views – Q2 2019

The beginning of 2019 is off to a hot start with the major stock indices within range of their all-time highs set last September, and enjoying their best start of the year going back to 1998. The Federal Reserve has come out in an unprecedented fashion to declare they will not raise rates the rest of 2019. The U.S. and China appear closer to a trade deal, but many disputes still linger with respect to automobiles and parts as further tariffs may be levied on Mexico and the EU. Global growth has moderated as China continues its transition to a more consumer driven economy. To offset the impact of U.S. tariffs, the Chinese government has allowed a loosening of credit to spur growth. With the U.S. government back open, will any important legislation get done in this lame duck session? How will Democratic investigations impact President Trump’s position and is there anything yet to surface that could still roil markets?

As mentioned in my previous quarterly update, I am still focused on Earnings, China, and Brexit.

Earnings – Profit margins remained high and buybacks surged in 2018, but top line sales disappointed in Q1. Analysts are revising their projections lower in Q2, though this may be viewed positively as market performance this cycle has tended to move inverse to analyst revisions. Year-over-year comparable numbers will be difficult to beat as fiscal stimulus wears off. I will be looking at companies’ forward guidance to see if their outlook is rosy, and if there is any continued concern over trade.

China – The Chinese market is off to a strong 2019 and with ample room to run. The continued leaks regarding a finished trade deal with the U.S. has helped lead it higher, as has a more dovish Fed. The government is still concerned with providing a soft landing but was needed to step in to provide stimulus late last year to prop up the economy. Chinese A-shares have begun the transition of being included in MSCI indices, thus opening their markets up to external financing.

Brexit – A euphemism for when you overpromise and under deliver. Britain was able to extend their exit date and may need to extend it even further. Seven different proposals were voted on in Parliament and all of them were defeated (ranging from joining a customs union to a hard Brexit to having a new referendum). A hard Brexit, though unlikely, would have immediate consequences not just for Britain but also mainland Europe. Inventory in Britain is 5x higher than the prior year as companies have begun to plan around the logistical nightmare of Britain leaving the EU with no deal. The ripple effects felt in the U.S. will be minimal, but there would still be a substantial impact on global markets.

Key Themes

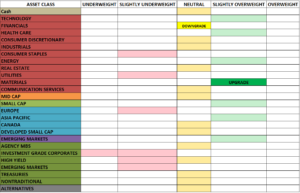

I continue to favor Cyclicals over Defensives

I continue to favor a slight overweight in Emerging Markets and Large Cap vs Small Caps and Developed Markets

Even after the strong outperformance by Emerging Market bonds and lower quality corporates in Q1, I still continue to favor higher quality fixed income and focusing risk-taking in equities

Key Risks

Interest Rates –

There is still a significant mismatch between the Fed and the bond market. The Fed is pricing in one hike for 2020, and one for 2021. The bond market is pricing in rate cuts starting next year. Either the Fed is wrong and will walk back their forecasts in upcoming meetings or the markets are wrong and will be caught off guard by any future rate hikes.

Poor Earnings Season –

In Q1, almost all of the positive gain was due to multiple expansion or share buybacks rather than an increase in earnings growth. A poor earnings season would cause this rally to sputter and put doubt in the minds of many market participants.

Model Changes

Upgraded the Materials sector to overweight and downgraded the Financials sector to neutral.

Companies in the Materials sector tend to outperform late cycle as we see a pick-up in inflation and a further extension of the bull market helped by a dovish Fed.

Financials have underperformed recently and with the Fed backtracking I see less upside potential as rates go down.

Written by: Antonio Belmonte, CFA, Chief Investment Officer

These are the opinions of Antonio Belmonte and not necessarily those of Cambridge, are for information purposes only, and should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. The strategies discussed herein are not designed based on the individual needs of any one specific client or investor. In other words, it is not a customized strategy designed on the specific financial circumstances of the client. However, prior to opening an account, Cambridge will consult with you to determine if your financial objectives are appropriate for investing in the model. You are also provided the opportunity to place reasonable restrictions on the securities held in your account.