Global Asset Allocation Views – Q2 2020

“It’s never paid to bet against America. We come through things, but it’s not always a smooth ride.”

- Warren Buffet

We enter the second quarter of 2020 amid our first bear market since the Great Financial Crisis of 2008. We are also under stay-at-home orders from Governor DeWine during this coronavirus pandemic and I hope each of you remains safe during these challenging times. As Warren Buffet alluded to in his quote, the ride may be bumpy but American ingenuity will get us through these times as it has done many times over the past 200+ years. During times like these, it is important to revisit your investment plan and to focus on the long-term approach we take together.

Thoughts on the Quarter

- Market Volatility – volatility will continue over the next few quarters. We experienced the fastest 30% drop in history as well as the longest stretch of oversold levels since October 2008. The mini rally we saw to end the quarter was from a bounce off of oversold levels, end of quarter rebalancing by pension funds, and window dressing from fund companies (wanting to show investors you owned the best stocks and none of the worst stocks).

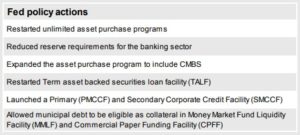

- Stimulus – the fast action taken by the Fed and Congress has shown that they will do whatever it takes. The actions undertaken back in 2007-2009 were much too slow and reactive. The prompt and proactive approach by both institutions will provide a solid foundation for a recovery. The idea of an infrastructure package, if passed by Congress, will also be another tailwind for the economic outlook. At the end I have provided the Fed policy actions and headlines from the CARES Act. The Fed has stepped up to provide ample liquidity to the banking system.

- Market Bottom – it is nearly impossible to predict a market bottom (and don’t listen to anyone that tells you otherwise). I do believe we need to see two things happen before we get a bottom. 1) We need to see a peak in coronavirus cases in the US and 2) we need to see the severity that the mandated shutdown has had on companies’ earnings. Many, if not all, companies have decided to postpone guidance in the interim considering the current uncertainties. Certain industries will suffer more than others (tourism, entertainment, retail ex-food and beverage, and restaurants/bars to name a few) while high quality companies with solid balance sheets will hold up better. I believe the opportunity to sell has passed and that it is important to stay invested. Markets are a leading indicator and will begin to turn before the economic indicators start to look better. It is important to remember that the best returns come right after the market bottoms.

Asset Allocation

The support level I was following in the S&P 500 was broken on February 27 and I took that opportunity to raise cash over the next week. I have added back to some equity positions on large down days but continue to hold a higher than average cash position. I have increased positions in low to negative correlated assets (Treasuries and Managed Futures) at the same time to reduce risk across the portfolios.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Written by: Antonio Belmonte, CFA, Chief Investment Officer

These are the opinions of Antonio Belmonte and not necessarily those of Cambridge, are for information purposes only, and should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. The strategies discussed herein are not designed based on the individual needs of any one specific client or investor. In other words, it is not a customized strategy designed on the specific financial circumstances of the client. However, prior to opening an account, Cambridge will consult with you to determine if your financial objectives are appropriate for investing in the model. You are also provided the opportunity to place reasonable restrictions on the securities held in your account.