Asset Allocation and Market Recoveries

Asset Allocation Dilemma

Money managers and individual investors have the dilemma of creating a proper asset allocation. The decisions involve assigning weights to equities, bonds, cash, and alternative strategies or asset classes to provide the best risk-adjusted return to match an investor’s goals and their risk tolerance. Think about the following scenario:

You are forced to invest all of your accounts for 20 years and are not able to look at or rebalance the portfolio. How would you invest this account? Based on historical performance and future projections, the correct answer would be 100% equities (some mix of large/small US stocks and international).

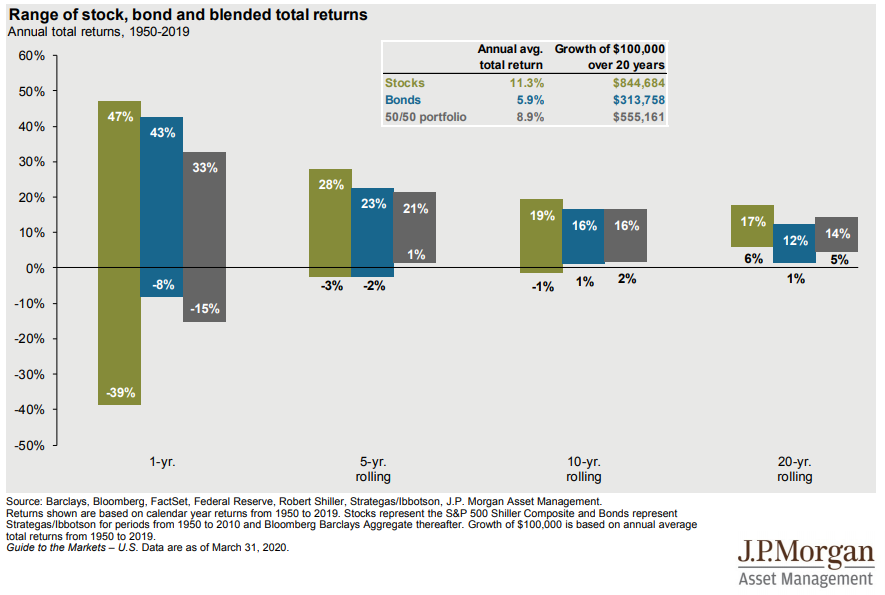

Now picture the same scenario but you are forced to invest for 1 year. How would you invest this account? Depending on your risk tolerance you would allocate some to equities to participate in market growth, some to bonds for interest, some to cash for security, and maybe some to alternatives to hedge equity risk. This scenario demonstrates that the ranges of outcomes are more significant the shorter the time frame (see chart below).

What we see from this example is that time is the friend of an equity investor. The longer your time horizon the more you should allocate to equities. We also learn that non-equity positioning helps to lower the risk in our portfolio and to provide security during times of volatility such as what we have seen this year.

Asset Allocation and Market Recovery

Having access to our accounts is a double-edged sword. We can reap the benefits from rebalancing, buying securities that are down and selling securities that are up, however, there is also the possibility of suffering from market timing and emotion-driven investing, buying securities that are up and selling securities that are down.

As the US begins to reopen up from stay-at-home-orders, we must look at what type of recovery we could expect. The majority of post-recession recoveries follow a V, L, or U shape.

V-shaped: this recovery would indicate a quick bounce back with minimal loss as referenced by the chart shape for a large number of economic indicators. This is the best-case scenario and would have the following features:

- An increase in pent-up demand

- Increased fiscal/monetary stimulus

- A quick return to pre-coronavirus sentiment

- A low probability of a large second wave

- What to buy: Emerging Markets, Industrials, Small Cap, Financials, Energy, and High Yield

L-shaped: this recovery would indicate a much slower recovery with growth never recovering to the trend line. This was what we saw after the 2008 Great Financial Crisis and would be a worst-case scenario

- Most likely see new market lows

- A stop to fiscal/monetary stimulus

- Subdued sentiment as a large number of individuals are fearful of catching the virus

- A high probability of a second wave

- What to buy: Consumer Staples, Health Care, Treasuries, Managed Futures, and to hold Cash

U-shaped: this recovery would indicate a slightly longer recovery but the ability to recover to the pre-coronavirus trend line. This would be my base case scenario. Markets are forward looking and bottom 6 months before economic indicators bottom. This is why unemployment can continue to worsen for months but the markets may remain well off their lows. The S&P bottomed on March of 2009 and yet unemployment did not bottom until August of 2009.

- Lows were made on March 23. Expect choppy trading and volatility for the next few months.

- More fiscal/monetary stimulus

- Lower sentiment, but many individuals gradually emerge to reignite the economy. There is pent-up demand even if the economy is only running at 90% as limitations remain.

- We have a plateau in cases but nothing that retriggers another round of stay-at-home orders

- What to buy: A mix of the asset classes and sectors above provides growth upside as well as downside protection.

As of this writing (May 6) we are about 50% from the bottom on March 23 and the same distance from the top on February 19. The whipsaw action over the past three months shows the importance of having a proper allocation to manage your portfolios in accordance with your goals. Proper risk management can protect your downside while still allowing you to participate in the upside.

As we make our way into the summer and the second half of the year, we at HFS wish you and your loved ones health and safety as we maneuver these difficult times.

Written by: Antonio Belmonte, CFA, Chief Investment Officer

These are the opinions of Antonio Belmonte and not necessarily those of Cambridge, are for information purposes only, and should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. The strategies discussed herein are not designed based on the individual needs of any one specific client or investor. In other words, it is not a customized strategy designed on the specific financial circumstances of the client. However, prior to opening an account, Cambridge will consult with you to determine if your financial objectives are appropriate for investing in the model. You are also provided the opportunity to place reasonable restrictions on the securities held in your account.