Our Newsletters

Newsletter Signup

The Future of Fiduciary Standards

The Future of Fiduciary Standards Fiduciary standards are alive and well, although they are in a state of transition and confusion. Do we look to the DOL (Department of Labor), SEC (Securities and Exchange Commission), or Individual State Regulators. Let’s first take...

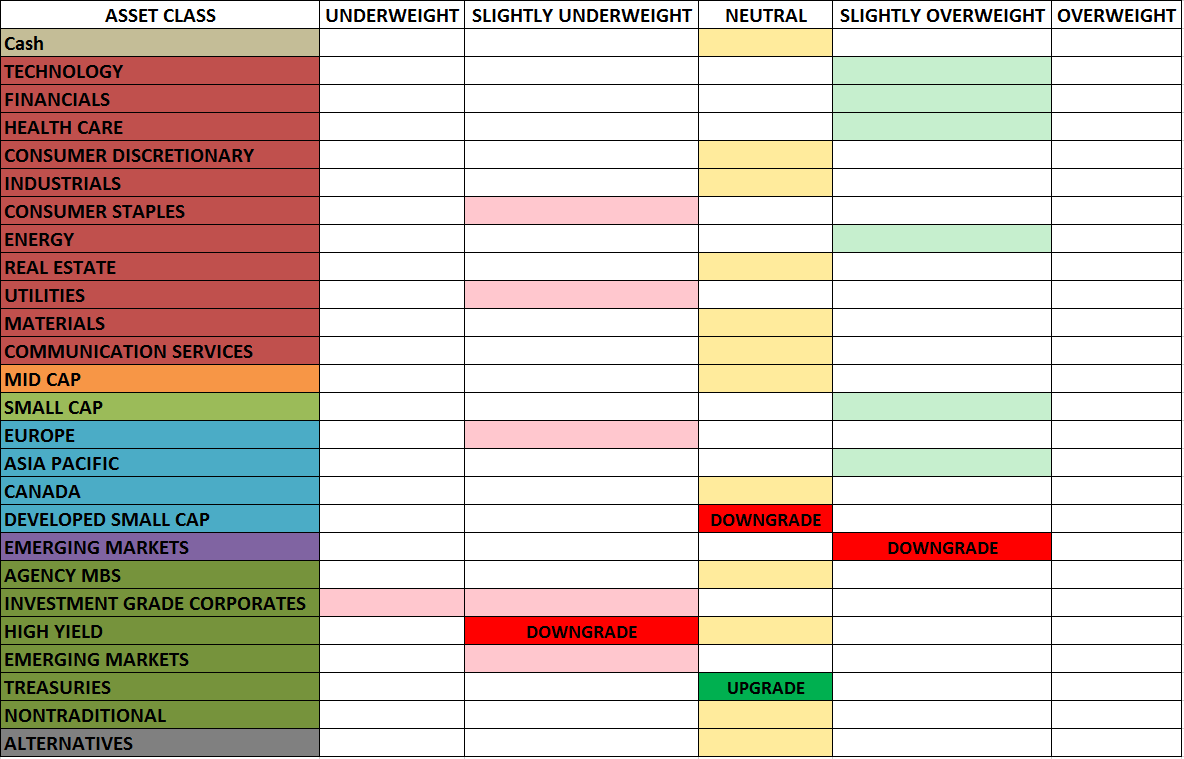

Global Asset Allocation Views – Q4 2019

Global Asset Allocation Views – Q4 2019 Markets – The S&P 500 eked out a 1.19% gain for the quarter. Europe, Emerging Markets, and Small Caps ended the quarter lower, unable to continue the momentum from the first half of the year. Defensive sectors continue to...

Are we in it for the long haul?

Are we in it for the long haul? Since 1960, the average American life expectancy rose from 69 years of age to 79 years of age, as modern medicine has made treatment more effective, complimented with more time being spent on preventative care, and thus boosting the...

Q3 Global Asset Allocation

Global Asset Allocation Views – Q3 2019 Q2 Highlights – Markets – The S&P 500 returned 3.79% to settle at its all-time closing high. The Russell 2000 (a representation of small cap companies) closed up 1.74% and posted a new two month high. International markets...

There’s a Retirement Crisis in America!

There’s a Retirement Crisis in America! Americans are struggling to save enough for retirement, therefore the House of representatives has passed “Setting Every Community Up for Retirement Enhancement Act of 2019” or SECURE Act by a bi-partisan vote of 417-3. The...

Global Asset Allocation Views – Q2 2019

Global Asset Allocation Views – Q2 2019 The beginning of 2019 is off to a hot start with the major stock indices within range of their all-time highs set last September, and enjoying their best start of the year going back to 1998. The Federal Reserve has come out in...

Crunch Time Tips for Tax Time

Crunch Time Tips for Tax Time Each year HFS strives to educate our team and our clients on helpful tips for tax time. Click here, New Year, New Tax Changes, for a review of the Tax Cuts and Jobs Act changes. You, your CPA, and your Financial Planner can work together...

Is Financial Stress Eating Up Your Profits?

Is Financial Stress Eating Up Your Profits? Financial stress is a silent killer that may be robbing your business of thousands or even millions of dollars of profit annually. Mercer estimated that employers lost approximately 250 billion in wages in 2017 because of...

Global Asset Allocation Views – Q1 2019

Global Asset Allocation Views – Q1 2019 Quarter in Review The 4th quarter of 2018 did not go as planned, though in reality nothing about investing truly ever goes to plan. The S&P 500 had just hit an all-time high and we were heading into historically...

Do You Know the Real Rate of Return On Your Investments?

Do You Know the Real Rate of Return On Your Investments? Many investors look at their monthly statements or review their account online and look at a couple of numbers to determine how their investments are doing. The first number is usually the balance in your...

Out with the old and in with the new…year?

Out with the old and in with the new…year? The year of 2018 is sprinting to the finish line. The snow is starting to fall and the fireplace is crackling as we hustle through December. Days like today are the best time to reflect on the year in review. Your reflection...

The ABCs of ESG

The ABCs of ESG What is ESG? ESG (Environmental, Social, and Governance) is an investment discipline focused on non-financial factors that investors have determined as being critical for a firm’s long-term performance. These factors focus on a variety of issues...

Global Asset Allocation Views – Q4 2018

Bulls and bears can both point to different sets of data to make their case on the markets. Bulls can point to continued strength in the Leading-Coincident Indicator which shows no sign of a recession and a flattening, but not yet inverted, yield curve which has...

You are the parent? So What?

You are the parent? So What? The applications are in, standardized tests are complete and a college decision has been made. Time is racing as college acceptance notices soon lead to freshman move in day. Now all there is to do is buy dorm supplies and drop the kids...

My Team, Our Team, Your Team

My Team, Our Team, Your Team It has been a whirlwind since I joined the HFS Wealth Advisors Team back in January. I am looking out my office window and I cannot believe it is July. Where did the time go? For you regular readers of HFS Headlines you are used to...

Global Asset Allocation Views – Q3 2018

Global Asset Allocation Views – Q3 2018 Markets have continued their wild ride in 2018 with U.S. markets gaining steam with the help of small caps. Meanwhile, international markets have been damaged by political issues, the strengthening dollar, and...

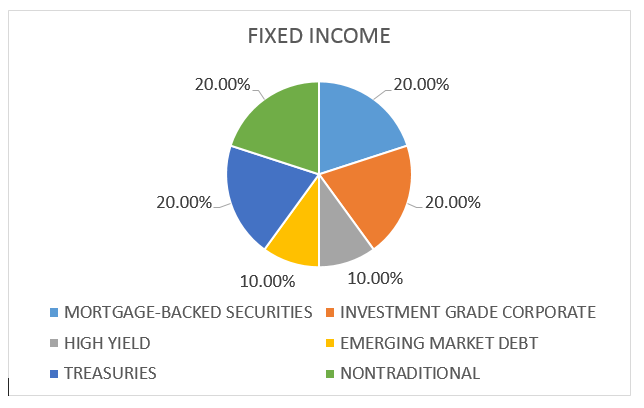

Making Sense of Fixed Income Investing

Making Sense of Fixed Income Investing The following are recent events that have begun to impact the bond market: Increased volatility in equities after a subdued 2017 Tightening monetary policy after years of low interest rates Fiscal stimulus (tax cuts) near the end...

College Planning – It’s Never too Early to Begin

College Planning – It’s Never too Early to Begin One of the greatest investments you can make is in your children’s education. A high quality education can be essential in helping your child get off to a successful start in their career. When preparing to save for...

Global Asset Allocation Views – Q2 2018

Global Asset Allocation Views – Q2 2018 It really did not take long for volatility to show up in 2018. After a first couple of weeks of parabolic moves in the equity markets, inflation and a fast pace of rate rises began to scare investors. These moves, along with...

5 Mistakes to Avoid in Creating Your Retirement Goals

Now is a great time to review your retirement goals and determine how well you are doing at accomplishing the goal you set for when to retire and what lifestyle you will live in retirement.

Alternative Facts

Alternative Facts For many investors, there are two main asset classes that are considered for portfolio construction: Equity and Fixed Income. Equities tend to be more volatile and provide the capital appreciation investors require to compensate for risk and to...

New Year…New Tax Changes

The 2017 year was an important one in Washington that promises to carry forward changes to each and every American tax payer in 2018 and beyond.

Global Asset Allocation Views – Q1 2018

Global Asset Allocation Views – Q1 2018 Last year turned out a lot quieter than many pundits had expected going into the year. The markets brushed off any potential geopolitical turmoil surrounding North Korea, Brexit, and trade wars with China. There were only...

Managing Risk and not Returns

Risk tends to be harder to quantify and thus seldom talked about by financial professionals.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and HFS Wealth Advisors are not affiliated. This communication is strictly intended for individuals residing in the states of AL, AZ, CA, CO, FL, GA, HI, IL, IN, KY, MA, MD, MI, MO, MS, NC, NJ, NV, NY, OH, OR, PA, SC, TN, TX, UT, VA, VI, VT, WA, WI, and WV. No offers may be made or accepted from any resident outside the specific states referenced.

Cambridge’s Form CRS (Customer Relationship Summary

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, HFS Wealth Advisors makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.